Peace of Mind for Your Mortgage

Set it up once, and let Savvy quietly work behind the scenes to help save you an average of £200,000 during your mortgage term.

That's £259 every month back in your pocket. No effort required.

Intelligent Monitoring

AI continuously tracks the market to find your perfect mortgage deal.

Life-Changing Savings

Save £200,000+ over your 25-year mortgage without lifting a finger.

Set-and-Forget Simplicity

Upload once and relax—we'll handle the monitoring and alert you when it matters.

Set it once, save on average £200,000

No constant research, no market tracking, no paperwork hassle. Just upload your mortgage details, then let our AI quietly work behind the scenes to save you money.

Set It Up Once

Upload your mortgage documents or enter your details in under 5 minutes.

- No paperwork hassle

- Bank-level security

- Works with any lender

AI Monitors 24/7

Our intelligent algorithms quietly work behind the scenes, scanning global markets.

- Continuous rate tracking

- Smart opportunity detection

- Zero impact on credit score

Significant Savings

Receive clear, timely alerts when better deals arise that make sense for your situation.

- Average £200,000 savings over 25 years (varies by mortgage)

- Guided switching process

- Paperwork handled for you

Why homeowners choose us

We're changing the way people manage their mortgages with smart technology and expert insights.

Smart Rate Monitoring

We continuously scan the market for better mortgage rates and alert you when significant savings are available.

- 24/7 market scanning

- Personalized rate alerts

- No impact on your credit score

Timely Alerts

Get notified at the optimal time to switch, typically 3-6 months before your current deal ends.

- Optimal timing analysis

- Customizable alert preferences

- No more rate shock

FCA Regulated

Your data and security are our top priorities. We're fully regulated by the Financial Conduct Authority.

- Bank-level security

- Read-only data access

- Fully encrypted

Everything you need in one place

Save Thousands

On average, our users save £2,340 per year by switching at the right time.

Save Time

No more checking rates or dealing with paperwork. We handle everything for you.

Fully Secure

We use bank-level security to keep your data safe and never store your banking credentials.

No Hidden Fees

What you see is what you get. No surprise charges or hidden costs.

Data Privacy

We never sell your data to third parties. Your information stays private and secure.

Smart Technology

Our algorithms analyze thousands of mortgage products to find your perfect match.

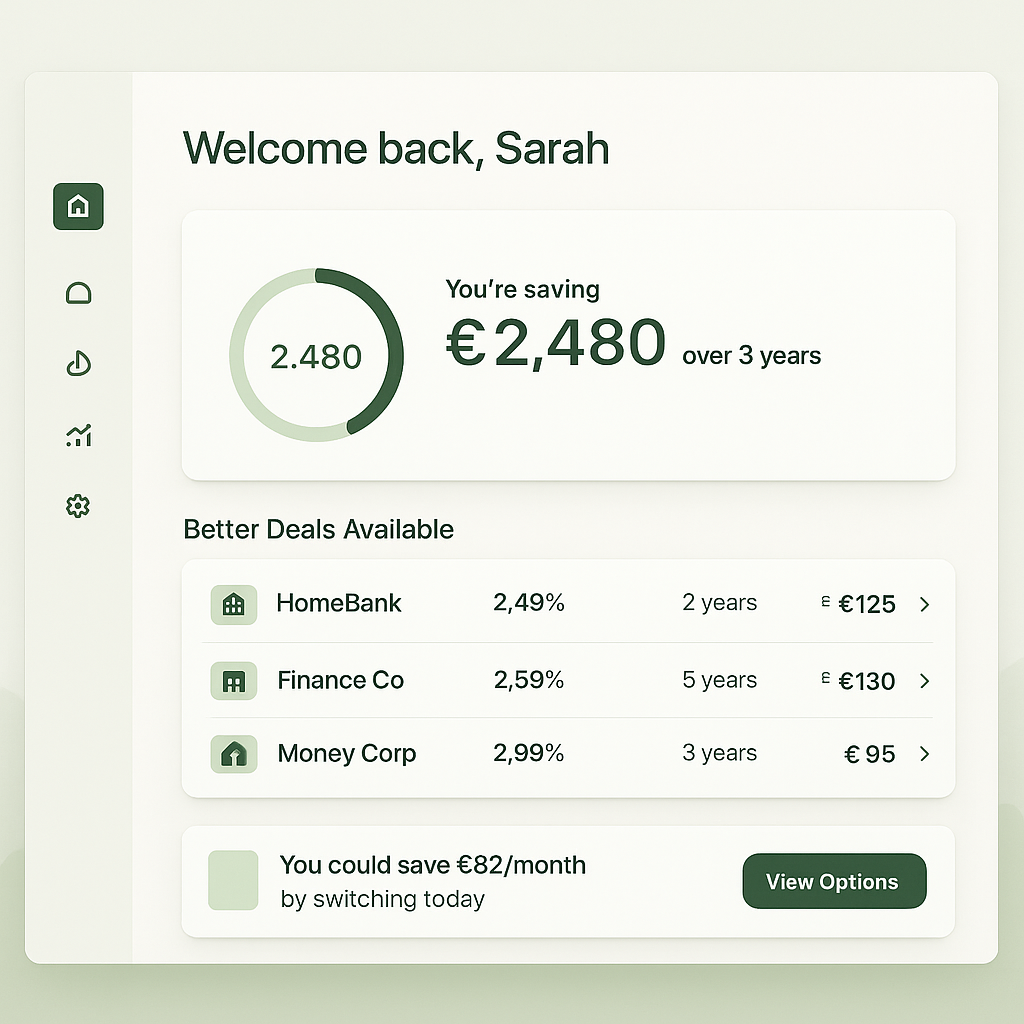

See how much you could save

Use our calculator to estimate your potential savings by switching to a better mortgage deal.

Your Potential Savings

Current Monthly

£1,390

Potential Monthly

£1,186

Your Monthly Savings

£204per month

Yearly Savings

£2,449

Total Over 25 Years

£61,216

*This is an estimate. Your actual savings may vary based on your specific circumstances.

Start saving up to £200,000 on your mortgage

Join our beta waitlist for exclusive early access and lock in our lifetime 50% discount when we launch.

Join the waitlist

What you'll get:

Early access to beta

Be among the first to experience our mortgage optimization platform

Lifetime 50% discount

Lock in our special beta pricing forever

Priority support

Dedicated support to help you maximize your savings

Next beta cohort opens: July 2025

Your mortgage questions, answered

Everything you need to know about saving with Savvy. Can't find the answer you're looking for?Chat with our team.

Still have questions?

We're here to help you save on your mortgage.

How much could I save with Savvy?

On average, our users save around £200,000 over 25 years (roughly £650/month), though individual results vary.

Your actual savings depend on your current mortgage rate, loan amount, and market conditions. Our AI continuously scans for the best deals tailored to your specific situation.

How does the free trial work?

Try Savvy free for 14 days—no credit card required. After your trial, continue with our £5/month plan (price locked for beta users). Cancel anytime with one click.

Is my financial data secure?

Absolutely. We use bank-level 256-bit encryption and never store your banking credentials. Your data is read-only and fully protected under GDPR and UK data protection laws.